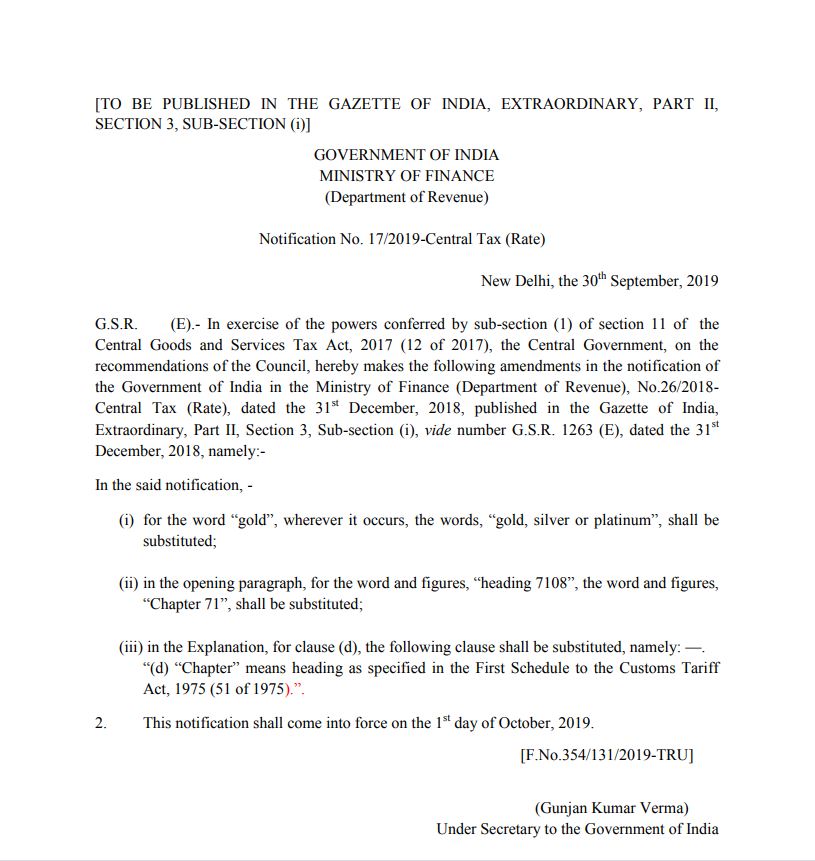

As per the GST Council meeting held on 20th September 2019, the council announced exempted or reduced Goods and Services Tax in the interest of the public. Of which, the GST is exempted on the export of Gold, Silver and Platinum. This revised rate of GST is effective from 1st October 2019.

The exemption of GST was announced to promote the exports from India. Apart from the precious metals, the exemption is applicable for the services provided by an intermediary agency to a supplier of goods or recipient of goods if both the supplier and recipient are located outside the taxable territory. Also, the mandatory declaration of the location of the service recipient for the companies in Research and Development (R&D) are exempted.

Measures for Export Promotion

a) Exemption from GST/IGST:-

(i) at the time of import on Silver/Platinum by specified nominated agencies (ii) supply of Silver/Platinum by specified nominated agency to exporters for exports of Jewellery

b) Inclusion of Diamond India Limited (DIL) in the list of nominated agencies eligible for IGST exemption on imports of Gold/ Silver/Platinum so as to supply at Nil GST to Jewellery exporters.

The rate changes shall be made effective with effect from 1st October, 2019.